According to IRAF News Agency, World Bank reports indicate that, Afghanistan’s economic growth reached 4.3% in 2025, while inflation remained stable at around 2%.

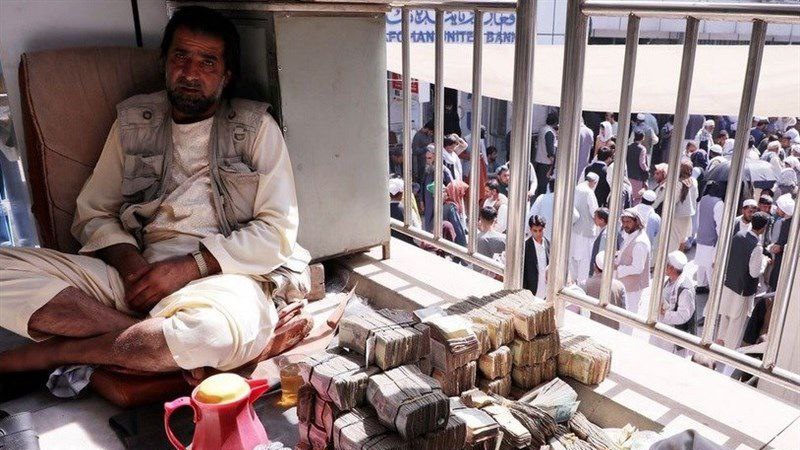

Rising agricultural production, coupled with growing unemployment and a rapidly increasing population, were among the key economic indicators for the year. Meanwhile, the country continues to face major challenges due to the central bank’s blocked assets abroad.

According to “2025 Global Multidimensional Poverty Index”, published by the United Nations Development Program, 64.9% of Afghanistan’s population live in multidimensional poverty, a measure that reflects simultaneous deprivation in education, health, and living standards, highlighting the persistence of a deep economic crisis.

Rising prices of imported goods and a population growth rate approaching 8% have further intensified financial pressure on households.

Return of millions of migrants worsens the livelihood crisis

In 2025, about 2.8 million migrants returned from Iran and Pakistan, an unprecedented wave that exacerbated unemployment and poverty. Simultaneously, severe earthquakes, recurring droughts, and seasonal floods across various provinces destroyed thousands of homes and economic infrastructures, triggering a new wave of internal displacement.

Foreign aid remains crucial to preventing economic collapse

Despite the full cessation of U.S. aid following Donald Trump’s administration, many countries and international organizations continued humanitarian support. The European Union, Arab states, Japan, North Korea, Canada, the United Nations, the World Bank, and the International Monetary Fund were among the main supporters of Afghanistan in 2025.

The UN humanitarian response plan required $2.42 billion for the year, but only $1.07 billion was secured. Nevertheless, according to Andrea Rattwate, deputy head of UNAMA, the UN used remaining funds from previous years to spend around $2.5 billion on supporting migrants and returnees—a move credited with preventing a “full-blown crisis”. Development assistance to Afghanistan in 2025 remained constrained, with less than $100 million allocated from the country’s trust fund for projects in health, education, livelihoods, and agriculture. Overall humanitarian and development aid for the year is estimated at $2.8–3 billion—a significant decline compared to previous years.

Mining: The Only Economic Highlight of 2025

Gold and precious stone extraction in Badakhshan, coal mining in Samangan, Baghlan, Takhar, and Bamyan, oil in Sar-e Pol, and emerald production in Panjshir were among the key economic activities.

The Taliban Ministry of Mines reported that revenues from mineral sales reached 17.112 billion Afghanis in 2025. In September, over 28 mining contracts worth $7.5 billion were signed with domestic and foreign companies, though the extent to which these deals have been implemented remains unclear.

Trade Disruption with Pakistan Hits Hard

A complete halt in trade with Pakistan during the last three months of 2025 cut Afghanistan off from one of its largest coal export markets. Over the past three years, Afghanistan exported 13–15 billion Afghanis worth of coal to Pakistan annually.

The stoppage of imports from Pakistan also caused sharp increase in the prices of key commodities; for instance, banana and orange prices in Kabul and Herat surged by up to 110%. Meanwhile, the suspension of fruit and vegetable exports to Pakistan resulted in losses of approximately $50 million for the Afghan economy.

Pivot to Iran, India, and Central Asia

In response to tensions with Pakistan, Afghanistan sought to redirect its trade routes toward Iran, India, China, Russia, and Central Asian countries. While this shift helped alleviate some immediate trade pressures, it also introduced serious challenges, including higher transit costs, reduced competitiveness of Afghan goods, inadequate infrastructure, and ongoing political uncertainty for investors.